How much I can commit to? Where will I invest? When do I want to start? Mr. Allen asked those 3 questions at the closing of our call. With the goal of retiring in 16 years, playing without hesitation and being worry-free of debt at the core of my decision making, I took action within 48 hours. Along with money management and beneficiary discussions, we addressed my parents’ well-being and future living arrangements.

The keys to my success:

1) Research (word of mouth) and hire a professional

2) Find out what you’re bringing in and what you’re paying out

3) Identify your “wants” and “needs”

4) Create a manageable budget

5) Take your time on making decisions

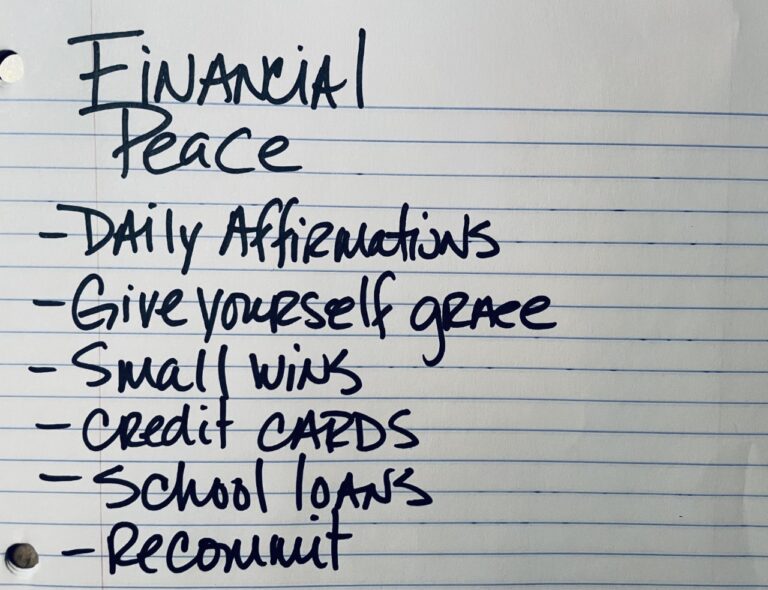

Understanding that this process will take work, trust and calculated risks to have successful outcomes, my intimidation feelings of money management is moving towards curiosity. Setting up the foundation and allowing the experts to do their job is something that I can control. For the next 2 years, I will be aggressive and will monitor as I go. Week 5: We decided to open two new accounts Roth IRA and Non-Retirement, and I doubled my contribution to the active 401K account. Week 6: Money was transferred over to start the investing process. Getting adjusted to the new monthly budget is work in progress. Week 7: We discussed the taxation process for the Roth IRA, 401K, Traditional IRA and Non-retirement accounts. Having multiple buckets of money levels the playing field if you need to withdraw funds. Depending on which political party is running the government will also dictate which account to pull from to avoid high tax rates. Mr. Allen explained the difference between stocks, bonds and mutual funds. Not going to lie, I started to fade to black. I’m totally interested, its just my attention began to focus elsewhere. He ended the call with early discussions of a POA (power of attorney), living will and a will.